Jun 6, 2024

Andrei Lebed

Back in March, I wrote about the ‘wild west of chatbots’ and gave a quick overview of the good, the bad and the ugly in chatbot development out in the market.

Today, I’m writing about chatbots' sophisticated older sibling - Digital Agents. It’s become clear to me that the way we communicate with our customers in the financial services industry is about to undergo a seismic shift. Digital agents, covering a multitude of different communication forms such as voice, text, chat and document processing, and powered by cutting-edge AI, are set to deliver customer interactions with the same accuracy as human agents, achieving huge operational efficiencies and changing the way we communicate with our customers for good.

Before we dive in, the distinction between AI copilots and digital agents is crucial to understand – while copilots assist humans in tasks, digital agents independently handle tasks on behalf of humans.

If what I’m writing about strikes a chord, leave a comment or reach out to me directly.

Digital Agents will take over customer communication 💬

Even though human-to-human communication remains prevalent in financial services, digital agents have now reached a level where they can consistently and accurately match human accuracy. By incorporating human-in-the-loop escalation and handoff mechanisms, you can now ensure easy queries are dealt with by your digital agent whilst complex queries are seamlessly transitioned to human agents when needed, optimising time spent and delivering top-notch customer service.

I believe we’re going to see a big shift towards this in the next year, and this is my prediction:

Digital agents will start off by sitting at the start of customer journeys, where they can support initial customer enquiries and hand them off to human agents where necessary (and relevant).

Digital agents will become multi-modal, branching out of the ‘chatbot box’ to different interaction types, such as voice calls or processing documents provided by a customer.

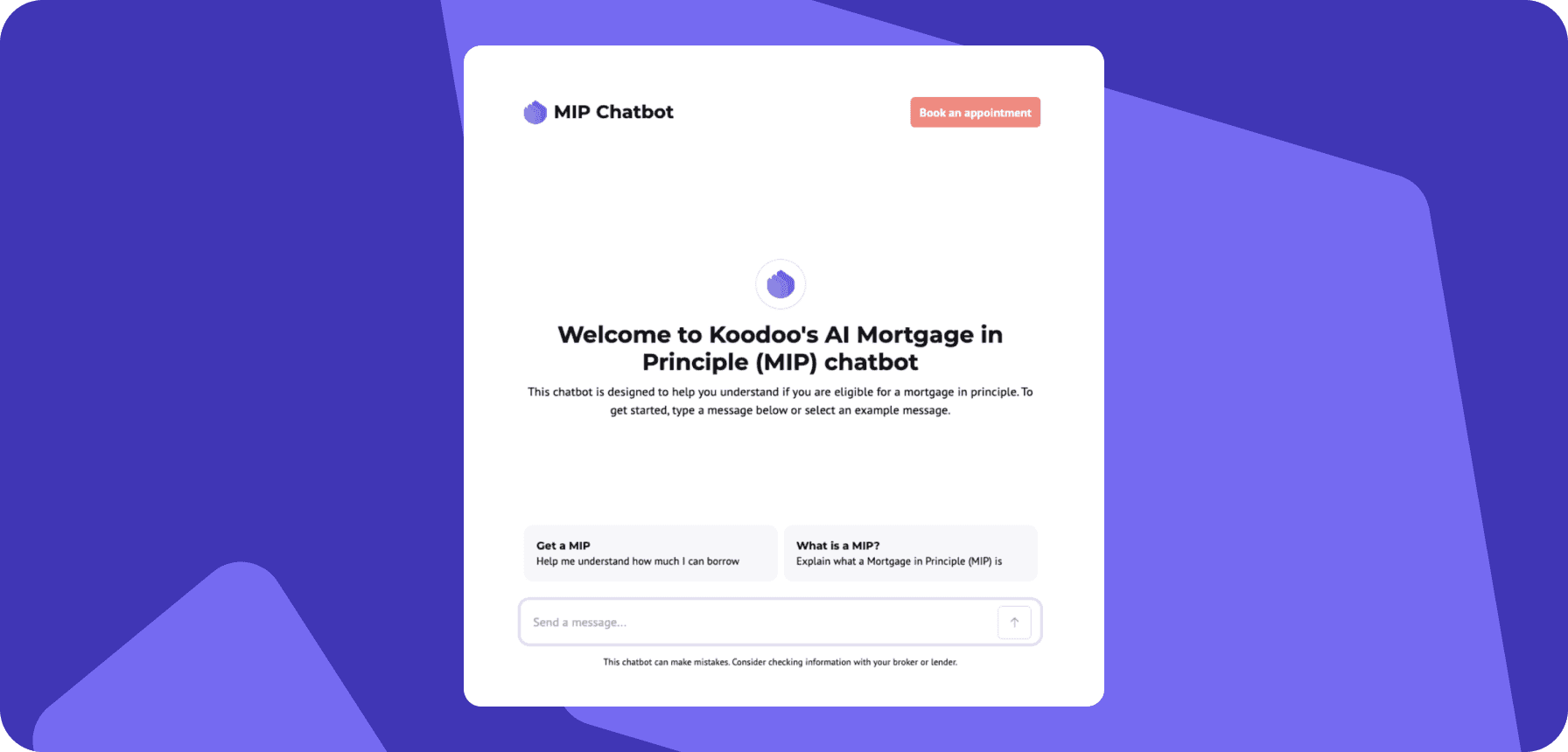

An example of a digital agent at the start of a customer journey is Koodoo’s Mortgage In Principle (MIP) Digital Agent:

For context, a mortgage in principle certificate allows a customer to understand what they can afford and is often necessary to start the house-viewing process and negotiate with sellers. To get an MIP, customers must either share personal information with a mortgage advisor or complete a lengthy online questionnaire, both taking at least 10-15 minutes. Exploring applicants find the process daunting, and those preferring self-service are often confused by complex terminology. This complexity leads to overreliance on human support and customers favouring human advisors face long wait times and long conversations.

We decided to make the application journey easier for applicants by integrating an MIP chatbot into our brokerage website so consumers can apply for their MIP in a natural conversation with the chatbot, get it issued immediately and get their questions answered.

What our chatbot does, is:

All customers who now ask “What can I afford?” go through a digital agent journey, freeing up broker time to deal with qualified leads.

We can service more customers, such as those browsing out-of-hours and those who would rather not pick up the phone. This reduces drop-off rates and keeps customers engaged and active.

The digital agent has multiple hand-off points to our agents, at which point they can pick up the case with full context and information supplied - making the next conversation quicker and more personalised for the customer.

The digital agent also allows high-risk customers to be triaged, e.g. those vulnerable or with adverse credit.

The digital agent can deal with a large range of questions often asked by less confident borrowers about the process. For example, if a customer asks if an MIP is the same as a full mortgage offer, the digital agent will be able to clearly outline the differences.

Why does it matter that the technology is Generative AI? 🤖

It matters because of the quality of natural conversation and flexibility in its contextual understanding. Digital agent chatbots using GenAI technology vastly outperform traditional OCR methods for several key reasons:

Natural Conversation: GenAI digital agents engage users in natural conversations, simplifying the mortgage application process by understanding different questions and being able to use their knowledge to answer accurately and correctly. It’s a level of flexibility that we’ve never seen before and will revolutionise customer communications.

Contextual Understanding: Generative AI technology can understand context, allowing a user to ask questions to support their journey through the MIP application process. The user can ask questions in their own language and style, and the digital agent will be able to understand, process & respond accurately. No more narrow and predefined questions only!

Personalised MIP Generation: Gen AI digital agents can take a natural conversation and use that information to generate MIPs tailored to each applicant, ensuring a more personalised experience.

Adaptability: These chatbots can quickly be re-trained to adapt to changing policies, allowing for swift updates to comply with new industry standards and business needs.

A few key considerations when thinking about digital agents... 🤔

1. Building a Unified AI Framework

At Koodoo, our work with the MIP chatbot and multiple digital agent prototypes has shown the need for a common framework. This framework must support digital agents across various modalities—be it audio, documents, or text. We have agreed that text is the fundamental language driving these interactions, enabling efficient agent routing and ensuring the right information is always at their fingertips.

Our digital agents are designed for a range of applications, from external-facing product finder chatbots to internal policy assistants for complex credit cases. By streamlining these applications within this common framework, we enhance efficiency and consistency across the board.

2. The Importance of Rigorous Testing and Data Quality

Deploying effective AI solutions starts with robust testing. At Koodoo, we begin with offline canonical test data, simulating real-world scenarios by sitting down with underwriters to answer a large number of questions together and iron out the unclear data sets. This internal release phase involves careful human review of transcripts, ensuring our models are finely tuned and reliable. Remember, "bad data in, bad data out." We hope that this process will move companies towards meeting to be more organised in how they store data and define their internal policies.

3. Monitoring AI Agents for Optimal Performance

At Koodoo, we believe in rigorous performance monitoring for both human and AI agents, ensuring AI agents meet performance KPIs and monitoring standards is a core responsibility at Koodoo. This involves creating a robust structure around our agents, supported by our engineering and LLM quality teams. These teams build canonical datasets, engineer prompts, revise structures, and continuously monitor and control the AI’s performance.

Note to the reader: there is so much more I could say on digital agents, with an endless number of applications - but for the purpose of this article I wanted to focus on the impact digital agents will have on external customer comms. Comment below what digital agent functionalities you’re most interested in or looking at and I can write about them next!

✅ Follow Koodoo on LinkedIn today for GenAI insights and real-world applications in financial services.